RE/MAX National Housing Report Q2 2021

HOUSING MARKET ACTIVITY RETURNS TO NORMAL

After a full year of living under lockdown restrictions of varying levels, the property market seems to have reached an equilibrium. This is according to Regional Director and CEO of RE/MAX of Southern Africa, Adrian Goslett, who refers to the RE/MAX National Housing Report for Q2 2021.

“The second quarter of 2020 saw the Deeds Office closure which meant that hardly any transactions were processed for three whole months. This was followed by a period of unprecedented activity as low-interest rates and pent-up demand drove the number of sales through the roof. This period of hyperactivity lasted longer than expected. However, looking at this quarter’s figures, it seems as though things might just be returning to usual,” Goslett remarks.

According to Lightstone Property data, a total of 40,696 bond registrations were recorded at the Deeds Office over the period of April to June 2021. The RE/MAX National Housing Report Q1 2021 reveal that this figure is 26% down from last quarter and, understandably, 603% up on Q2 2020’s figures as reported in the National Housing Report Q2 2020.

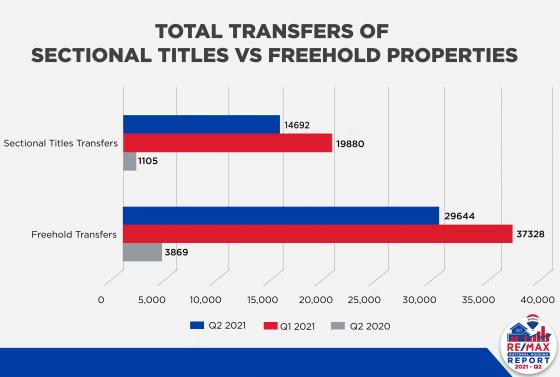

The number of transfers (both bonded and unbonded) recorded at the Deeds Office between April to June amounted to 58,846*. This amount is 22% down on the figures recorded in Q1 2021. However, compared to the mere 5,941 recorded in Q2 2020, the figure grew by 891%.

Of the 58,846 transfers, a total of 29,644* freehold properties and 14,692* sectional title units were sold countrywide (these figures exclude estates, farms, and land only transfers). The number of freehold properties registered increased by 666% YoY and shrunk by 21% QoQ. Sectional titles increased by over 1000% YoY but shrunk by 26% QoQ.

“There are a few reasons why we may be seeing that the number of transactions are decreasing quarter on quarter. One of which might be that the Deeds Office has finally caught up with the backlog of registrations that resulted from its closure in the earlier stages of lockdown. A second possible explanation might be a healthy level of caution from buyers as interest rates are likely to increase at the next meeting to combat rising inflation. Another reason might be that activity is simply returning to pre-lockdown levels as is to be expected within the natural ebb and flow of demand,” Goslett suggests.

House Prices Remain Steady

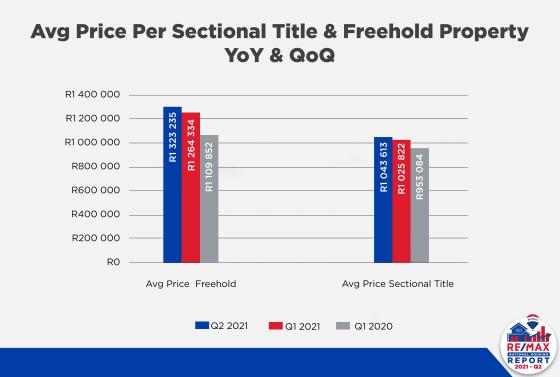

According to Lightstone Property data, the nationwide average price of sectional titles for Q2 2021 is R1,043,613 and the nationwide average price of freehold homes is R1,323,235.

When reviewing the figures from previous RE/MAX National Housing Reports, the price of sectional titles grew by 9% YoY and 2% QoQ. Freehold properties grew by 5% when compared to Q1 2021 and by 19% when compared to Q2 2020. According to Lightstone, year-to-date, the Average Price Changes per annum for sectional titles is 5% and 9% for freehold properties.

“With inflation sitting at 5,2% in May from 4,4% in April, property price appreciation (particularly among freehold title holders) is still holding steady against inflation despite the volatility of the economy as we battle through the pandemic,” Goslett remarks.

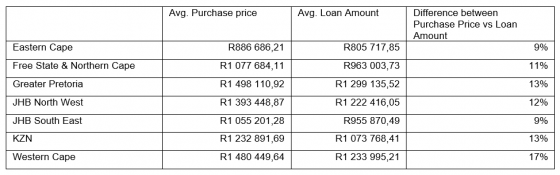

Lightstone Property data also reveals that the average bond amount granted during this period amounted to R1,247,000. The RE/MAX National Housing Reports reflect that this is an increase of 1% since last quarter and of 26% since Q2 2020.

Activity remains the same within price brackets

Sales priced between R800,000 and R1,5 million continue to account for the largest portion at 27.1%* of all transfers occurring in Q2 2021. Following this figure were transfers priced below R400,000 which now account for 24%* of all transfers in Q2. Transfers between R400,000-R800,000 follow close behind this at 23.1%* of the total transfers. Sales between R1,5 million to R3 million accounted for 19.4%* and those priced above R3 million accounted for 6.5%* of the total transfers this quarter.

Market Performance Per Province

The top five searched suburbs on remax.co.za were Morningside in Gauteng with 2563 searches followed by Parklands in the Western Cape with 2547 searches. This was followed by Plumstead and Sunningdale in the Western Cape with 2533 and 2478 searches, respectively. And, lastly, Fourways in Gauteng made the bottom of the list at 2432 searches.

According to stats provided by Private Property, despite having dropped by R5,000, the Western Cape continues to have the highest median asking price at R2,495,000 million. This is followed by the Northern Cape at R1,692,000. KZN placed third at R1,695,000. Limpopo saw the highest year-on-year growth at 10,1% and Gauteng saw the largest decline of -3,2% YoY.

** Disclaimer: The data reflected herein represents data that is voluntarily obtained from subscribers from the Private Property South Africa’s website and is based solely on data collected by Private Property South Africa (Pty) Ltd. Further, the data reflected herein is accurate as per the Private Property South Africa database dated 05 July 2021. Reliance on such data is at the sole discretion of subscribers and Private Property South Africa hereby indemnifies itself of any consequence of such reliance.

Final thoughts on Q2 2021

“In the last Housing Report, I predicted that hard times were ahead as many industries continue to be affected by the various lockdown restrictions. I also predicted that the market would not continue to be as active as it was for much longer. I think this quarter’s figures present us with the actualization of these predictions. However, conditions can change in a heartbeat and so it is impossible to predict with any certainty how the property market will perform going forward. That being said, real estate will always be a sound investment strategy when looking for long-term returns. Those who hope to time the market to maximise their returns should seek the advice of an experienced real estate professional who can keep them up-to-date on trends and the latest market conditions,” Goslett concludes.

*Figures according to Lightstone Property

Send to a Friend